Recession Proof Your Business

The technical definition of a recession is two consecutive quarters of negative GDP (Growth Domestic Product). On a more simple level, it means there’s less cash flowing through the economy, which means consumers will have less money to spend. If consumers are spending less, it’s safe to figure that our businesses will make less, which means we’ll spend less. This will ultimately result in less production. After all, why would any business want to invest capital in producing something that won’t sell.

Recessions often catch many off guard, because most don’t pay attention to economic trends. Ignorance only has the illusion of bliss. I say illusion because it may feel good in the moment, because we can spend carefree. However, when the rooster comes home to roost, we have the sad realization that our income is 30% lower than it once was.

In 2008, I was relatively fresh into business ownership. I didn’t understand the true woes of a recession. My wife and I owned a fashion Boutique in Broomfield, CO. The boutique was located in a fairly well-to-do neighborhood. Sales were regular and we were able to pay expenses as well as ourselves.

Suddenly, it was as if someone flipped a switch. It was October 2008. The stock market was in free fall due to the collapse of real estate, marking the end of the Lenders-Gone-Wild era. Many of our customers worked for Sun Microsystems. Sadly, most of them lost their jobs in massive layoffs across the board.

Mass layoffs are common in recessions. As a result of this, our sales numbers hit rock bottom. We couldn’t pay ourselves nor the rent. Ordering new merchandise would have been an issue, except the inventory we had wasn’t moving, so there was no point in that. Without financial backing and banks fearing to loan money to anyone, we eventually found ourselves with no other option other than to close the store.

I wish we’d been better prepared for this. Sure, it would’ve hurt still, but not nearly as bad. That’s why I’m writing this article. I’m writing in hopes that you’ll take heed and prepare yourself. As President Eisenhower once said, “I’m certain no battle has ever been won according to plan. I’m also certain no battle has ever been won without one.” Below are four pointers to help you prepare against recession. If there is never another recession, you are still better off having read and taken heed to what’s provided in this article.

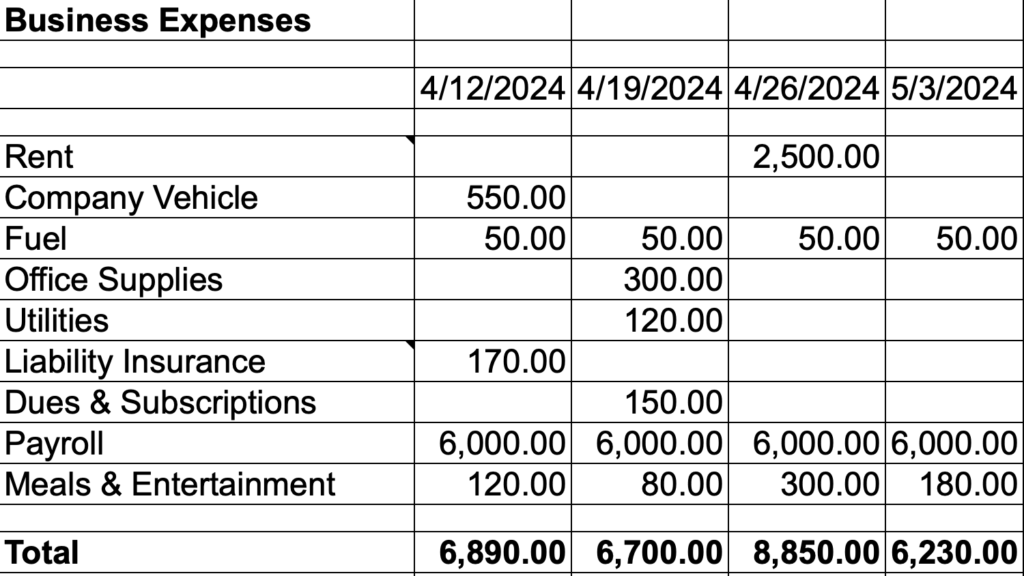

Evaluate Expenses: Where is your money going? This question may be more challenging to answer if one doesn’t keep detailed records of expenses. If you haven’t kept detailed records of expenses, you can start now. You can track your expenses in Google Sheets. It’s absolutely free and easy to use. I’ve included a sample below so that you can start recording your expenses today.

You’ll want to be extremely detailed with this process. If there are any expenses that you incur on a monthly basis, make sure that they are recorded here. If you’re buying coffee for the office or just for yourself, it should be recorded. When you’re done with this process, you want to have a crystal clear picture of where your money is being spent.

Once you have the picture clearly drawn, it’s time to start cleaning house! Before you begin, ask yourself if the expense is a must have or a nice to have. Be honest with yourself as you’ll be the one to pay the price if you’re not. If you can get by without the expense, consider reducing the amount spent on it or eradicating it entirely. If it’s a must have, can you find it at a cheaper price without compromising the integrity of your business or offering. The main idea here is to reduce your business expenses to equal less than 70% of your business income. The closer you get to this number, the better prepared your business will be for survival.

Savings: We’re often taught to save 10% or more of our personal income, but rarely are we taught to save 10% or more of our business income. In 2020, I learned that Apple had more than $200 Billion in cash. I thought, wow, this is a company that’s prepared! It’s estimated that they could’ve gone two years without any revenue and still continued to operate without laying off any employees. Even today, whilst many Fortune 500 companies have laid off 10s of thousands of employees, Apple has not. They only recently laid off 900 workers because they canceled the Apple car concept.

I’m not saying that we can each save as much as Apple, but savings relevant to our operating size is achievable. It’s amazing what we can live without when we’re forced to do so. Why not have the discipline to force ourselves to live on less during times of plenty, so that we can be ok and possibly thrive in the downtimes. It of course starts with getting our expenses under control, so please don’t skip that step. Once this is accomplished, start saving; keeping in mind that the clock is ticking.

Income Review: Are the prices you’re charging today consistent with what the market is willing to pay? If not, this may be an opportunity for you to consider increasing your prices, and thereby, your income. This will help your bottom line as well as help you to start saving. One of the greatest benefits of owning a business is the ability to set your own prices. If inflation increases, you can increase your prices equally as long as people are willing to pay them.

When recession hits, you may have to reduce your prices, because consumers will have less money to spend. However, for the time being, you get to make a little more and save a little more. Again, the more you save, the better prepared you’ll be for a recession.

Restructuring Debt: Borrowed funds can bring a business to life. It can also be the death of a business if not properly managed. As interest rates increased in 2023, many consumers and business owners alike found themselves hit hard by increased payments that weren’t decreasing their credit card balances. If you had a variable rate credit card, your debt holder can charge you more interest on existing debt. If you have a fixed rate credit card, they can still raise the interest rate, but only on new purchases. Depending on the amount of debt carried on the card, the new payments could be rather steep, hundreds of dollars per month in some cases.

One of the things you can do to restructure debt is to consider doing a balance transfer to a new card that offers anywhere from six to twelve months interest free on transferred balances. Then, try to pay off as much of that balance as possible before the term expires. When you’re close to term expiration and you’re still carrying the balance, transfer it to a new card. As long as your credit is good, the new bank will be happy to have you. The key is to transfer the balance prior to the term expiration; otherwise, some banks will charge you back interest for the previous six to twelve months.

Another solution could be to refinance your debts to merely extend the terms. Proceed with caution on this one as it will save you on monthly expenses, but cost you more on the lifecycle of the loan. That said, the decrease in monthly expenses could be key to reducing expenses. You may even consolidate multiple loans, but make sure that the consolidation strategically makes sense. I personally wouldn’t recommend refinancing an extremely low interest rate loan for a much higher interest rate loan. The monthly savings might not be worth it.

Under no circumstance would I refinance my home to pay off debt. For one, the lifecycle cost of such a loan would cost you far more over 30 years of paying interest. Heavens forbid you end up filing for bankruptcy, but better to keep your house and write off the debt than to lose it all. Sounds grim, but these things happen. Yes! Even to those who think it could never happen to them.

Layoffs: No one wants to layoff valuable employees, but sometimes you get to a point where you can take care of a few, but not many. As aforementioned, many large corporations have been doing layoffs over the past year. The claim was that it’s due to AI, but one has to wonder if they were more so preparing for an incoming recession.

I don’t have a crystal ball showing me the future. The best I can do is analyze data and check it against historical data. When I look at the national debt, personal debt, rising credit card balances, rising unemployment and/or underemployment, inflation, credit defaults and soaring bankruptcy filings, I’m thoroughly convinced there’s only a matter of time before the banks are forced to stop frivolously lending. When that happens, it’ll only exacerbate the problem. Many are already experiencing recession on a personal level.

My personal take is the only reason we’re not in a technical recession today is because our government is spending all that we have plus one trillion dollars every 100 days. Government spending, outside of social security, contributes to GDP.

Trillion just rolls off the tongue now. Trillion is the new billion. We’re becoming desensitized to the fact that there are twelve zeros in a trillion. We’re sending out more money to fight more wars that we clearly can’t afford to support. It reminds me of the British and how they lost their place as the world super power. We’re out of control and the rooster will eventually come home to roost.

Knowledge isn’t power. Knowledge is potential power. The true power is using knowledge to put ourselves and hopefully others in a better situation. You’ve been armed with knowledge. Now it’s time to take action. Don’t get willfully blindsided. Prepare yourself. Prepare your business. Recession is coming!

Written by:

Eric L. Lipsey | Founder | Owner

VENTRE Capital, Inc.

www.VentreCapital.com